FSS percentage from accidents. Calculation of insurance premiums for injuries. Additional rates of insurance premiums for compulsory pension insurance

In the course of performing their work duties, employees may be injured, mutilated, or acquire an occupational disease. The result is temporary or permanent loss of professional ability to work. In turn, this may result in the employee losing earnings, being recognized as disabled, and other negative consequences.

Mandatory social insurance against industrial accidents and occupational diseases is aimed at protecting the property interests of workers whose health has suffered as a result of their work functions.

The essence of this insurance is that the employer is obliged to pay insurance premiums for employees. And workers who have acquired an occupational disease or been injured have the right to an appropriate insurance payment.

What are contributions for insurance against industrial accidents and occupational diseases (the so-called “injury” contributions) and what is the procedure for their payment by “simplified”, an article prepared by experts from the berator “STS in Practice” will tell you.

Object of taxation and tax base

The main document that regulates insurance against industrial injuries is the Federal Law of July 24, 1998 No. 125-FZ “On compulsory social insurance against industrial accidents and occupational diseases.”

Contributions go to the Social Insurance Fund of the Russian Federation (FSS RF). They pay benefits to employees who have suffered an accident at work or received an occupational disease.

Contributions are paid by organizations and entrepreneurs who hire workers under employment contracts.

If a civil law agreement (for example, a contract agreement) is concluded with an employee, then the employer (organization or entrepreneur) will have to pay contributions only when this is expressly provided for in the agreement.

Contributions are paid on all payments transferred to the employee within the framework of labor relations and civil contracts.

There are a number of payments for which contributions are not required. The list of these payments is given in Article 20.2 of the Federal Law of July 24, 1998 No. 125-FZ:

- amounts paid in compensation for harm caused by injury or other damage to health, within the limits established by the legislation on compulsory social insurance against industrial accidents and occupational diseases;

- amounts paid as compensation for the cost of benefits in kind, which are due to employees by law (for example, employees of customs authorities, prosecutors, military personnel, etc.);

- severance pay, with the exception of compensation for unused vacation upon dismissal;

- compensation paid when moving to work in another area within the limits established by the legislation of the Russian Federation;

- reimbursement of the cost of travel to and from the vacation destination for employees working in the Far North and members of their families;

- one-time financial assistance provided to an employee in connection with the death of a member of his family;

- one-time financial assistance provided to those employees who suffered from terrorist attacks on the territory of the Russian Federation;

- one-time financial assistance provided to employees (parents, adoptive parents, guardians), which is paid at the birth (adoption) of a child during the first year after birth, but not more than 50,000 rubles for each child;

- insurance premiums that an organization pays for its employees under voluntary personal insurance contracts concluded for a period of at least one year, providing for payment by insurers of the medical expenses of these insured persons;

- the amount of insurance payments (contributions) of the organization for its employees under voluntary personal insurance contracts in the event of harm to health or death of the insured employee;

- contributions from companies aimed at co-financing the pension savings of their employees, but not more than 12,000 rubles per year for each employee;

- cost of training for basic and additional professional educational programs.

note

The object of taxation and the basis for calculating contributions for “injury” and contributions for compulsory social insurance are completely the same.

In March, an organization using the simplified tax system paid its employees salaries (totaling 120,000 rubles) and bonuses based on work results in the first quarter (90,000 rubles).

In addition, one of the employees was paid financial assistance in the amount of 50,000 rubles. in connection with the birth of a child (the child was born in February of this year).

A “simplified” company must pay contributions from the amounts of salaries and bonuses paid:

120,000 + 90,000 = 210,000 rub.

There is no need to pay contributions on the amount of financial assistance. In April, the company entered into a civil contract with an individual for the provision of warehouse renovation services. The contract contains a condition that the employer undertakes to pay insurance premiums to the Federal Social Insurance Fund of the Russian Federation for the contractor.

In the same month, the company entered into a civil contract with an individual for the provision of legal services, which does not contain such a condition, that is, the employer does not undertake to pay insurance contributions to the Social Insurance Fund of the Russian Federation under this contract. Thus, in April, the contractor performing repair work is considered insured, but the person providing legal services is not. The company is obliged to pay contributions in April in the first case, and is not obliged to pay in the second.

Calculation and payment of contributions

The tax period for contributions is a year, and the reporting period is the first quarter, half a year and 9 months.

Contribution rates

The premium rate (insurance rate) depends on the type of activity you carry out, more precisely, on the professional risk class assigned to you.

The class of professional risk to which the main type of activity of the organization belongs is determined according to the Classification of Types of Economic Activities, approved by Order of the Ministry of Labor of Russia dated December 25, 2012 No. 625n.

All types of activities are divided into 32 occupational risk classes. For example, retail trade is classified as 1st class, the printing industry is classified as 2nd, etc.

The following insurance rates correspond to professional risk classes:

| Occupational risk class | Insurance rate, % |

| 1st | 0,2 |

| 2nd | 0,3 |

| 3rd | 0,4 |

| 4th | 0,5 |

| 5th | 0,6 |

| 6th | 0,7 |

| 7th | 0,8 |

| 8th | 0,9 |

| 9th | 1 |

| 10th | 1,1 |

| 11th | 1,2 |

| 12th | 1,3 |

| 13th | 1,4 |

| 14th | 1,5 |

| 15th | 1,7 |

| 16th | 1,9 |

| 17th | 2,1 |

| 18th | 2,3 |

| 19th | 2,5 |

| 20th | 2,8 |

| 21st | 3,1 |

| 22nd | 3,4 |

| 23rd | 3,7 |

| 24th | 4,1 |

| 25th | 4,5 |

| 26th | 5 |

| 27th | 5,5 |

| 28th | 6,1 |

| 29th | 6,7 |

| 30th | 7,4 |

| 31st | 8,1 |

| 32nd | 8,5 |

Taking into account the provisions of Article 1 of the Federal Law of December 14, 2015 No. 362-FZ, in 2016 it is necessary to apply the insurance rates established by Article 1 of the Federal Law of December 22, 2005 No. 179-FZ for 2006.

If you carry out several types of activities, then you will be assigned a class based on the type of activity from which you receive the most revenue.

In the future, your company must annually confirm the main type of its activity no later than April 15. To do this, it is necessary to submit to the territorial office of the Social Insurance Fund the documents specified in the Procedure for confirming the main type of activity of the insured for compulsory social insurance against industrial accidents and occupational diseases.

The territorial branch of the FSS can provide you with a discount on the insurance rate or, conversely, set a premium to it. A company that:

- operates for three years from the date of state registration;

- pays current insurance premiums on time;

- has no debt on insurance premiums.

To receive a discount, you must submit a corresponding application to the territorial office of the fund no later than November 1 of the year preceding the year for which the discount is established.

No later than December 1, the fund must decide whether to provide a discount or not. The fund will notify you of its decision within 5 days.

If a positive decision is made, the fund will send you a notice of the new amount of insurance premiums for compulsory insurance against industrial accidents and occupational diseases. At the same time, both the discount and the surcharge will begin to apply from January 1 of the next year. The maximum discount (surcharge) cannot exceed 40% of the insurance rate.

The methodology for calculating discounts and allowances for insurance rates for compulsory social insurance against industrial accidents and occupational diseases was approved by Order of the Ministry of Labor of Russia dated August 1, 2012 No. 39n.

The company's activities belong to the 2nd class of professional risk. The insurance rate that the company must apply is 0.3%.

The territorial branch of the Social Insurance Fund provided the company with a discount on the payment of the premium - 25% of the insurance rate.

In March, the company paid its employees a salary of 310,000 rubles. You need to pay fees in the amount of:

310,000 rub. × 0.3% (100% – 25%) = 697.5 rub.

Procedure for calculating contributions

The amount that needs to be transferred to the Social Insurance Fund is calculated using the formula:

The accrued contribution amount is determined by multiplying employee benefits by the insurance rate.

note

Some policyholders pay premiums of 60% of the insurance rate.

These are, in particular:

- organizations that pay remuneration in cash or in kind (including remuneration under civil contracts) to employees with disabilities of groups I, II and III;

- public organizations of disabled people (including those created as unions of public organizations of disabled people), among whose members disabled people and their legal representatives make up at least 80%;

- organizations whose authorized capital consists entirely of contributions from public organizations of disabled people and in which the average number of disabled people is at least 50%, and the share of wages of disabled people in the wage fund is at least 25%;

- institutions that are created to achieve educational, cultural, medical and recreational, physical culture, sports, scientific, information and other social goals, as well as to provide legal and other assistance to people with disabilities, disabled children and their parents, the only owners of whose property are the specified public organizations of disabled people.

If an employee suffers from an accident at work or receives an occupational disease, the employer is obliged to pay him an appropriate benefit (insurance compensation) from the Social Insurance Fund. The amount of compensation is determined by the territorial branch of the fund.

Unlike personal income tax, payment to the Social Insurance Fund is made not from the income received by the employee, but from the organization in which he is engaged in labor activities. After the organization’s accounting department has carried out payroll calculations, it is necessary to calculate the percentage that should be transferred to the Social Insurance Fund. The complexity of this procedure is that the amount of insurance premiums depends not only on the employee’s income, but also on the percentages used to calculate contributions.

As with paying various types of taxes, contributions must be paid within the specified time frame. If this requirement is not met, the employer is subject to penalties from the FSS. In addition to making timely payments, organizations must regularly fill out reporting forms that provide information about funds paid into the fund.

Currently the Social Insurance Fund rate is 2.9%. But, in addition to the regular transfer of this amount, a Pension Fund contribution of 22% is also deducted from each employee’s income. A regular payment to the Compulsory Medical Insurance Fund is added to these contributions. The amount transferred to it should be 5.1% of the employee’s total income. When calculating all fees, it turns out that the organization is obliged to transfer 30% of the income paid to the employee.

The percentage calculated by the Social Insurance Fund must be transferred to the fund not by the employee himself, but by the organization where he works.

Depending on the situation, the amount accrued by the fund will have a specific value.

For example, in a situation where an employee is ill, the amount of payment from the fund will be based on two factors: previously made transfers to the fund from the employee’s salary, as well as the length of his work at his current job. At the same time, the amount transferred from the employee’s salary to the fund does not depend on the frequency of insurance situations. The amount of the amount subsequently paid by the fund in the event of illness and the employee going on maternity leave also does not depend.

See also the video about changes in insurance premium rates up to 2018 inclusive:

Deadlines for paying contributions to the fund

To carry out the procedure for paying contributions calculated based on employees’ salaries, a period of up to the 15th day of the month following the month being paid is allocated. Organizations are required to transfer contributions every month. Thus, depending on the size of the employee’s salary and his possible illnesses, the amount transferred to the fund may vary slightly.

The amount of monthly payment of contributions by organizations is calculated as follows. To obtain the exact amount of contributions that must be made for the past month, the amount of benefits that were accrued from the Social Insurance Fund in the current month is used. From this amount, contributions going towards insurance cases related to maternity and illness are deducted. These contributions include accruals made at the basic rate, as well as at the reduced rate. The resulting amount will be the mandatory contribution that must be paid to the company for the past month.

Example of step-by-step calculation

The calculation of the amount paid to the Social Insurance Fund occurs in several stages:

- The amount of income paid to employees registered in the organization is calculated.

- Funds for physical expenses are added to the resulting single amount. persons conducting temporary activities in the organization.

- From the amount thus received, the amount of benefits previously issued by the Social Insurance Fund to the organization’s employees is subtracted.

The amount transferred by the organization to the fund, calculated from the employee’s salary for an accident, is only 0.2%. Depending on the number of days of activity of the employee, the amount of the salary, as well as the transferred amount, is subject to change. The amounts transferred monthly to the fund are subsequently added up.

What are contributions to the Social Insurance Fund used for?

All amounts transferred to the fund by the organization are intended to support the financial situation of the organization’s employees in a number of unforeseen situations. Situations in which an employee is entitled to financial assistance include:

- Temporary disability associated with employee illness. The funds paid by the fund are used to repay part of the amount spent by the employee on treatment.

- The necessary rehabilitation of an employee in a sanatorium or other institution is partially compensated by funds from the fund.

- Unemployed. For people who do not have official employment, the fund provides temporary financial support.

- Pregnancy. For this case, the fund provides a special allowance.

- Birth and subsequent care of the child. For the entire period of sick leave, the fund makes a special payment of benefits.

- Support for preschoolers. The fund constantly transfers funds to partially provide them.

- Insurance system. There are always shortcomings, and to eliminate them in the current social insurance system, the fund allocates certain amounts.

Insurance premiums for injuries in 2018in terms of the main points relating to their calculation and payment, they are subject to the same rules that were in force in 2017. Let's look at these main points.

Deductions for injuries - principles of calculation

After the transition of the main volume of insurance premiums from 2017 to the control of the tax authorities, deductions for injuries turned out to be the only payment that continues to be paid to the extra-budgetary fund. The procedure for calculating insurance premiums for injuries in 2018 is still regulated by the Law “On Compulsory Social Insurance...” dated July 24, 1998 No. 125-FZ.

The basis for their calculation is the amount of remuneration accrued by employers in favor of employees (Clause 1, Article 20.1 of Law No. 125-FZ). However, a number of such payments are regarded as non-taxable (Article 20.2 of Law No. 125-FZ). The latter include state benefits, compensation payments, financial assistance and some others.

The amount of contributions for injuries to be paid is determined monthly, based on the volume of the calculation base accumulated from the beginning of the year until the end of the month for which contributions are calculated (Clause 9, Article 22.1 of Law No. 125-FZ).

The tariff established for the policyholder is applied to this base, the value of which, in comparison with the generally accepted value for the corresponding class of pro-free insurance, can be reduced by the fund. The volume of the reduction is determined by the absence of fatal consequences of accidents, the presence of the results of a special assessment of working conditions, the facts of medical examinations, the volume of social insurance expenses, is considered based on the results of activities for the 3 years preceding the reduction, and can reach 40% of the generally accepted tariff value (clause 1 of Art. 22 of Law No. 125-FZ).

The amount of contributions payable for the last month is calculated by subtracting from their value calculated from the volume of the base accumulated since the beginning of the year those amounts that were accrued for the months preceding the month of calculation.

Current tariffs - regular and for disabled people

What are the rates of contributions for injuries in 2018? They continue to correspond to the values introduced by the law “On Insurance Tariffs...” dated December 22, 2005 No. 179-FZ (Article 1 of the Law “On Insurance Tariffs...” dated December 19, 2016 No. 419-FZ).

The rate of contributions for injuries in 2018 still depends on the class of professional insurance (Article 1 of Law No. 179-FZ), and assignment to the appropriate class depends on the type of activity performed (Order of the Ministry of Labor of Russia dated December 30, 2016 No. 851n).

Read about the values of the current tariffs in the publication.

In addition, the rule established by Law No. 179-FZ (Article 2) to reduce contributions by 60% continues to apply:

- to all legal entities regarding payments to disabled people;

- organizations created by people with disabilities or to help them.

Also in 2018, contributions for injuries from payments to disabled people using rates of 60% of the generally established tariffs are charged to individual entrepreneurs (Article 2 of Law No. 419-FZ).

Rules for payment of insurance premiums for injuries in 2018

Payment of insurance premiums for injuries in 2018, as in previous years, must be made monthly, transferring the amount accrued for the past month to the fund. The deadline for such a payment expires on the 15th day of the month following the month for which the calculation was made (clause 4 of Article 22 of Law No. 125-FZ). Due to the coincidence with general weekends, it may be postponed to a later date corresponding to the nearest weekday.

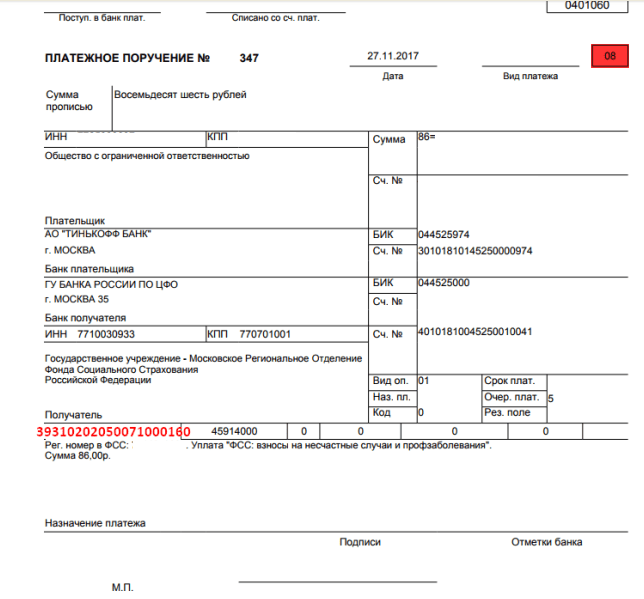

Upon payment, the payment document will be issued to the address of the regional branch of the Social Insurance Fund in which the payer of contributions is registered. That is, the recipient’s data will contain the name, TIN, checkpoint of the corresponding FSS branch and its details in the treasury.

Mandatory information will also be the payment code, contribution payer status code (08), OKTMO, codes for the period and nature of payment, and a description of the purpose of the transfer.

When paying contributions for injuries in 2018, the BCC is the same as in 2017, i.e. 39310202050071000160. Other values of this code may arise when paying a penalty (393 1 02 02050 07 2100 160) or a fine (393 1 02 02050 07 3000 160).

Reporting on deductions for injuries in 2018

Reporting on injuries in 2018 remains submitted quarterly in the month following the end of the next quarter, no later than (Clause 1, Article 24 of Law No. 125-FZ):

- on the 20th, if the report is generated on paper (insured persons with an average number of no more than 25 people have this right);

- On the 25th, if delivery is made electronically.

To compile it, form 4-FSS is used, approved by Order of the FSS of the Russian Federation dated September 26, 2016 No. 381 in its current version. The same document contains rules for reporting. Data is entered into the form as a total that increases from quarter to quarter. Only those tables for which the necessary data are available must be filled out.

Along with Form 4-FSS, one more report is submitted - on the use of insurance funds to implement measures to reduce injuries at work.

The legality of applying a certain tariff when calculating contributions requires annual confirmation of the type of activity being carried out. The deadline for confirmation is defined as April 15 of the year following the one for which the information substantiating the type of activity is generated (clause 3 of the confirmation procedure approved by order of the Ministry of Health and Social Development of Russia dated January 31, 2006 No. 55).

Results

There are no fundamental innovations in the rules for calculating and paying insurance premiums for injuries in 2018 compared to 2017. They are still paid to the Social Insurance Fund. Reporting on contributions is also submitted there.

Question to the expert: “What are the insurance premium rates for injuries in 2019? Where can I find the table and rates?

The Russian Federation has adopted a system of monetary compensation to an employee for health damage caused at work on the basis of pre-paid insurance contributions. All relationships are carried out through the Social Insurance Fund (SIF), specially created under the Ministry of Finance of the country.

The law regulating the rules for employees' contributions to the Social Insurance Fund was adopted in 1998 (No. 125-FZ). In subsequent years, the law was revised several times. The latest changes were made through an add-on released on December 30, 2019. These changes concern the order of deductions in 2019, and I must say the changes are quite significant.

The first, visible difference is that the management of some types of insurance premiums was transferred to the Federal Tax Service (FTS), while maintaining the general management of the Social Insurance Fund, which, in addition to controlling cash flows:

- Calculates the actual amounts of insurance payments, and,

- Controls actual payments when insured events occur.

Please note that the insurance payment rate depends on:

- Specializations of the enterprise (or individual entrepreneur), and,

- Availability of an individual discount benefit that reduces the initial tariff.

Additions for 2019 concern:

- methods of calculating fines,

- recovery of uncollected amounts,

- timing and nature of control activities,

- In addition, settlement and reporting periods of activity have been established.

The fundamental provisions for working with insurance premium rates are the following:

- An employment contract must be concluded with the employee;

- If the nature of the work requires it, a civil contract must also be concluded;

- Payments are made regardless of the employee's citizenship (in other words, the employee may not be a citizen of the Russian Federation).

Payments to the Social Insurance Fund are made from the following amounts of money paid to the employee:

- wage;

- bonus;

- allowance;

- compensation for vacation that was not used.

At the same time, payments to the Social Insurance Fund are not made with:

- government benefits;

- payments in case of staff reduction (liquidation of a company);

- financial assistance paid in emergency cases;

- compensation payments for work in hazardous or especially difficult conditions for health;

- tuition fees for advanced training courses.

Tariff rates are set as a percentage of the specified payments and are divided into 32 classes of professional risk established by the first paragraph of Federal Law No. 179-FZ, adopted in 2005.

We present the full interest rates of tariffs for all 32 classes of professional risk.

| Risk class | Tariff (%) | Risk class | Tariff (%) |

|---|---|---|---|

| 1 | 0.2 | 17 | 2.1 |

| 2 | 0.3 | 18 | 2.3 |

| 3 | 0.4 | 19 | 2.5 |

| 4 | 0.5 | 20 | 2.8 |

| 5 | 0.6 | 21 | 3.1 |

| 6 | 0.7 | 22 | 3.4 |

| 7 | 0.8 | 23 | 3.7 |

| 8 | 0.9 | 24 | 4.1 |

| 9 | 1 | 25 | 4.5 |

| 10 | 1.1 | 26 | 5 |

| 11 | 1.2 | 27 | 5.5 |

| 12 | 1.3 | 28 | 6.1 |

| 13 | 1.4 | 29 | 6.7 |

| 14 | 1.5 | 30 | 7.4 |

| 15 | 1.7 | 31 | 8.1 |

| 16 | 1.9 | 32 | 8.5 |

Please note that the classification of types of economic activities by occupational risk classes was approved by Order of the Ministry of Labor of the Russian Federation No. 851n dated December 30, 2019. The new order establishes the codes adopted by Rosstandart by order No. 14-st dated January 31, 2014.

As can be seen from the table above, As the risk of injury at work increases, so does the payout ratio. If we take into account that initially such hazardous industries have increased wage rates, then the payments made will be significantly higher.

So, for example, with a total monthly payment of 60 thousand rubles to a first-class employee, the payment amount will be only 120 rubles.

So, for example, with a total monthly payment of 60 thousand rubles to a first-class employee, the payment amount will be only 120 rubles.

If an employee earns 60 thousand in a hazardous production class 32, then the payment is already 5,100 rubles.

Employers should pay attention to the nuance introduced on January 1, 2019 - the risk class of each employee must be confirmed annually with the Social Insurance Fund before April 15 of the current year. If such confirmation is not received by the Fund on time, then risk class 32 will be established, which is categorically against the interests of the employer, and, therefore, stimulates his desire to comply with this requirement of the Law.

Please note that the employer will no longer be able to correct or challenge this mistake this year; he will have to wait for the onset of the new annual reporting period.

The algorithm for determining the payment rate for injuries is simple and is as follows:

- Using the All-Russian Classifier of Types of Economic Activities (OKVED), we determine the activity code according to the specialization of the enterprise.

- Next, we define the class according to the received code.

- Knowing the class, we obtain the tariff as a percentage of wages (generalized, taking into account all payments).

To determine insurance rates for the current year, the employer is required to confirm the type of economic activity for the previous year, for which he must send the following documents to the Social Insurance Fund:

- statement confirming the main type of activity;

- explanatory note to the balance sheet (individual entrepreneurs are exempt from providing this document);

- confirmation certificate.

Thus, the formula for calculating insurance payments for injuries is:

Insurance premiums =

(Payments under an employment agreement or civil contract - Non-taxable payments) x Tariff rate for contributions according to the table above

Here are the budget classification codes (BCC) of insurance premiums for injuries in 2019:

- The actual insurance premiums for injuries are 393 1 02 02050 07 1000 160;

- Penalties for errors when transferring insurance premiums – 393 1 02 02050 07 3000 160;

- Penalties for late payment of insurance premiums – 393 1 02 02050 07 2100 160.

As before, the state encourages the hiring of disabled people of groups I, II and III. For each such employee, the payment to the insurance fund is reduced by 60%. The Ministry of Labor and Social Policy has already announced that this benefit will be maintained for the next 2 years, 2018 and 2019.

Please note that the professional risk class depends on the main type of business activity, which was indicated by the entrepreneur when registering in the Unified State Register.

Many people are interested in what they will be like insurance premium rates in 2017. Table, in our opinion, is the most convenient form to reveal the whole picture of contributions for the near future.

Changes

It's no secret that Contribution rates to state social funds are the second most important mandatory payments after taxes. The insurance premium rate is a magnitude that will inevitably fall on the shoulders of employers - companies and businessmen.

Let us recall the main legislative progress in this area: since 2017, the bulk of the powers have passed to the Russian Tax Service. This is control over deductions based on current insurance premium rates, debt collection and receiving + analysis of reports.

These amendments are already present in the regulatory framework. Thus, from January 1, 2017, the Law on Insurance Contributions No. 212-FZ will disappear into oblivion, and a new Chapter 34 of the Tax Code will take its place.

| What will remain the same | Reporting periods: first quarter, half year and 9 months |

| Billing period – year | |

| Who is obliged to pay - firms, individual entrepreneurs, lawyers, notaries and other private practitioners | |

| Object – same payments | |

| Dimensions reduced insurance premium rates | |

| The basis for calculating contributions - the rules are almost the same | |

| What will change | Reporting forms, because you will have to send them to the tax authorities |

| Report submission deadlines | |

| The criteria that must be met in order to be eligible for the application have been spelled out in more detail + the list of such requirements has been expanded | |

| The moment of loss of the right to reduced insurance premium rates: it is now indicated that this happens “retroactively” - from the beginning of the year |

Next, let's look at what it will be like. Let us immediately note that social tax rates in 2017 saved. For example, income tax (personal income tax) remained at the same level. This suggests that the state really does not want interest rates on insurance premiums in 2017 year to put pressure on business.

Insurance premiums 2017: rates, table

The table below shows insurance premium rates for 2017. The tariff rate (insurance rate) is percentage of contributions.

Contribution rates in 2017(see table)

| Where | Why | Insurance premium rates, % |

| To the Pension Fund for OPS | 22 | |

| Payments exceed the base limit | 10 | |

| To the Social Insurance Fund for temporary disability and maternity | Payments do not exceed the base limit | 2,9 |

| Payments exceed the base limit | No need to charge | |

| FFOMS: rate in 2017 year | – | 5,1 |

2017: reduced insurance premium rates

We hasten to please you that the minimum tariffs of insurance contributions to state extra-budgetary funds continue to operate in 2017. True, only a select few can count on them.

| Type of insurer and activity codes according to OKVED | Tariff for calculating insurance premiums | ||

| To Pence. fund, % | To the Social Insurance Fund (except for injuries), % | FFOMS: rate 2017 of the year, % | |

| "Simplified" with: 1) a preferential type of activity; 2) income from it - from 70% of the total volume; 3) profit for the year – no more than 79 million rubles. (otherwise loss of the right to a reduced tariff from the beginning of the year) Codes: 13 – 16, etc. | 20 | ||

| “Impositions”: pharmacies and merchants with a pharmaceutical license. The right to [reduced insurance premium rates] is only for pharmaceutical personnel. Codes: | 20 | ||

| Individual entrepreneur on a patent in relation to hired personnel (for some types of activities there are exceptions) Codes: | 20 | ||

| NPOs on the simplified tax system (except for government agencies) areas: Social services for citizens; Codes: | 20 | ||

| Charitable organizations are “simplistic” Codes: | 20 | ||

| IT companies Codes: | 8 | 2 | 4 |

| JSCs, LLCs and partnerships on the simplified tax system, which implement the results of intellectual activity, the rights to which are held by budgetary and autonomous (including scientific) institutions Code: 72. | 8 | 2 | 4 |

| An agreement was signed with the management authorities of special economic zones for: introduction of new technologies; development of a tourism cluster. Codes: | 8 | 2 | 4 |

| Payments and rewards to crews of ships registered in the Russian International Register (there are a number of exceptions) Code: 50. | |||

| There is status as a participant in the Skolkovo project Code: 72.1 | 14 | ||

| There is the status of a participant in the free economic zone in Crimea Codes: any, except 05, 06, 07, 08, 09.1, 71.12.3. | 6 | 1,5 | 0,1 |

| Has the status of a resident of a priority development territory Codes: for each territory the type of activity is determined individually | 6 | 1,5 | 0,1 |

| I have resident status in the free port of Vladivostok Codes: any, except prohibited ones (see the decision of the Supervisory Board of this free port). | 6 | 1,5 | 0,1 |

2017: accident insurance premium rate

Finally, let’s look at what it will be like in 2017 social contribution rate(FSS) for injuries.

On our website table of insurance premium rates in 2017 regarding emergencies at work and professional ailments.

Let us remind you that the law obliges you to prove each year that the rate of contributions for “injuries” that was initially established is correct. A package of documents - an application along with a confirmation certificate - must be submitted to the Social Insurance Fund before April 15 of the year in which you expect to apply accident insurance premium rate.

Thus, in order to receive the tariff for 2017, you need to send documents before April 15, 2017. Since this day falls on Saturday, the transfer rule applies. Therefore, try to confirm your “price for injuries” before 04/17/2016 inclusive.

Please pay special attention that from January 1, 2017, the Government of the Russian Federation has adjusted the Rules for classifying types of economic activities as occupational risk. Its essence is this: if the company has not confirmed the main type of its activity, social insurance will automatically assign the highest risk class from those OKVED codes that were declared during state registration in the Unified State Register of Legal Entities.

In essence, these changes consolidated a practice that had already been established. It's just that everything is absolutely official now. Meanwhile, previously many conflicts with the FSS on this issue came to court. And the latter supported mainly companies. The logic was based on the fact that it is impossible to arbitrarily put into the strictest framework. But now the fund will not take into account only those types of activities that the company actually carried out in the previous period.